how do you calculate cash flow to creditors

Rated the 1 Accounting Solution. Multiply the number of bonds the company wants to buy back by the bond price in the market.

Debtors Creditors Control Accounts Accounting Basics Financial Peace University Accounting

Use your B2B receivables to finance your business expenses.

. Operating Cash Flow Formula. Add the three amounts to determine the cash flow from assets. A Debt Free Finance Alternative.

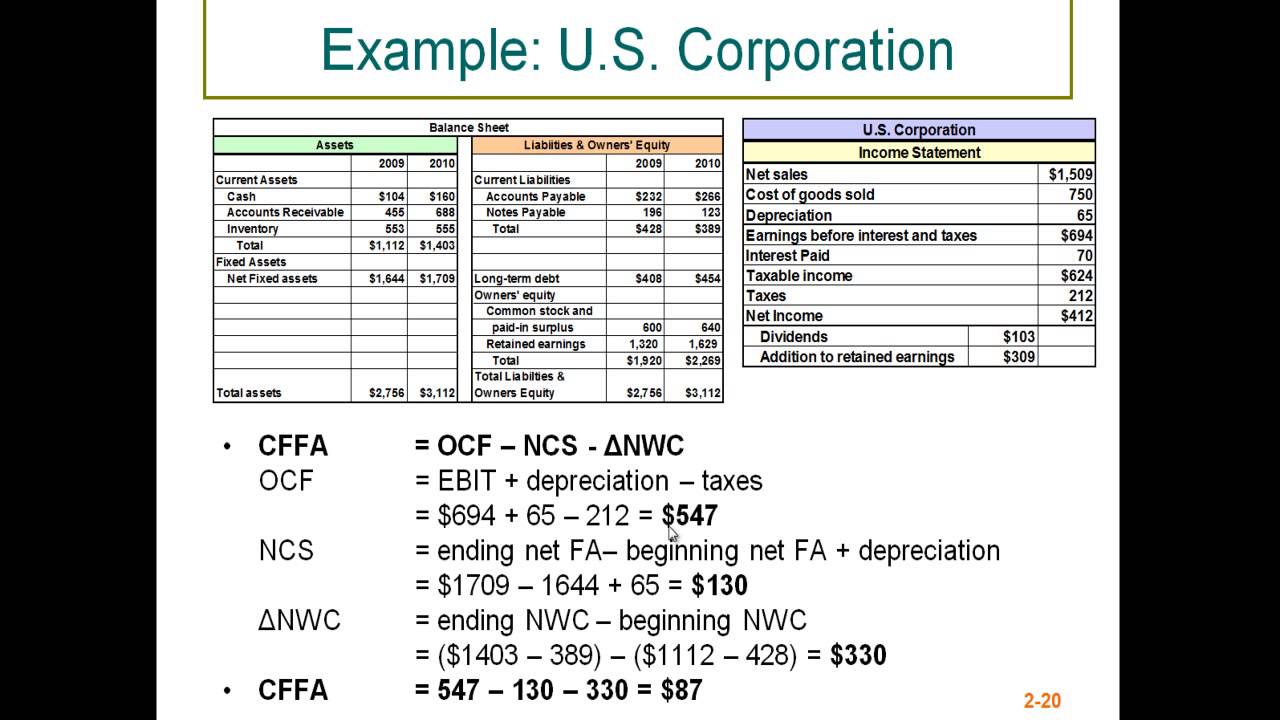

Cash flow to creditors Interest paid New long-term debt Cash flow to creditors Interest paid Long-term debt end Long-term debt beg Cash flow to. Ad QuickBooks Financial Software. Operating cash flow total revenue - operating expenses.

Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times. Operating Cash Flow Net Income -. Have Great Cash Flow and A Great Balance Sheet.

Once they have these three numbers Johnson Paper Company can calculate their cash flow from assets. Forecast your future cash position and regain your control on your business finances. A positive cash flow is good for the company as it determines financial success and a negative cash flow says otherwise.

The FCF formula is Free Cash Flow Operating Cash Flow Capital Expenditures. If a company has an operating income of 30000 5000 in taxes zero. Rated the 1 Accounting Solution.

Free Cash Flow Net Operating Profit After Taxes Net Investment in Operating Capital where. Select Popular Legal Forms Packages of Any Category. Net Operating Profit After Taxes Operating Income 1 - Tax Rate and where.

It is noteworthy that this amount will equal cash flows to creditors plus cash flows to stockholders which shows how you can draw a line between this and the balance. How To Use the Direct Method for the. All Major Categories Covered.

This is the amount of cash the company has to pay its creditors to retire the debt. The cash flow to creditors is. There are two different methods that can be used to.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Ad QuickBooks Financial Software. The direct method of calculating operating cash flow is as follows.

Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital. Ad All Industries Served. Since so many transactions involve non-cash items you have to alter how you calculate their effect on cash flow.

In 2017 free cash flow is calculated as 18343 million minus 11955 million which equals.

Cash Flow From Assets Definition And Formula Bookstime

Cash Flow To Creditors Calculator Calculator Academy

The Accounting Equation Is The Best Methods In Principle Of Accounting

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Cash Flow To Creditors Calculator Calculator Academy

What Is The Trial Balance Definition Format Example

Training Modular Financial Modeling Annual Forecast Model Debtors Creditors Creditors Modano

Download Depreciation Calculator Excel Template Exceldatapro

Blank Income Statement Template Fresh Blank In E Statement And Balance Sheet Aoteamedia Statement Template Income Statement Mission Statement Template

How To Prepare Projected Balance Sheet Accounting Education Balance Sheet Accounting Education Accounting Principles

Training Modular Financial Modeling Annual Forecast Model Debtors Creditors Creditors Modano